Now is the time to fight Insurance fraud using behavioural detection technology!

Use Case for RA7 Service Centre model at Censeo (South Africa)

During the POC phase in 2014, Censeo’s investigation unit analyzed a total of 30,000 insurance claims, forwarded to it AFTER initial screening by the insurance companies in-house fraud prevention means.

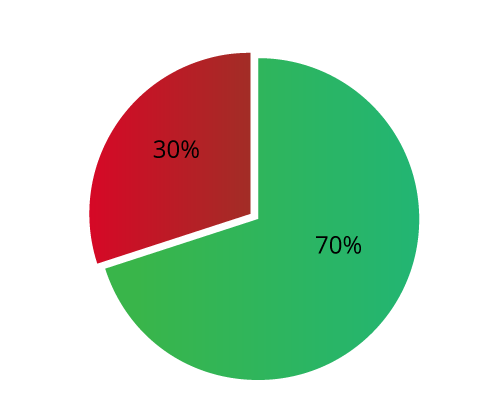

Using RA7, about 20,000 claims (70%) were found to be “Low Risk” and should not be investigated, improving customer service to the rightful claimants, as well as saving just about *15,000,000 US$ in costs and travel expenses.

During the POC phase in 2014, Censeo’s investigation unit analyzed a total of 30,000 insurance claims, forwarded to it AFTER initial screening by the insurance companies in-house fraud prevention means.

Using RA7, about 20,000 claims (70%) were found to be “Low Risk” and should not be investigated, improving customer service to the rightful claimants, as well as saving just about *15,000,000 US$ in costs and travel expenses.

(*Based on $750 expenses per case, including airfare, hotels & investigator’s work)

RA7 is used as a secondary screening tool, evaluating cases that raised suspicion by other means. Using RA7, the honest claims that failed due to initial evaluation by other means were served faster and hassle free due to the low risk score.

*(https://www.prnewswire.com/news-releases/insurance-fraud-detection-market-to-reach-28-1-bn-globally-by-2031-at-24-2-cagr-allied-market-research-301580103.html)

*(https://www.prnewswire.com/news-releases/insurance-fraud-detection-market-to-reach-28-1-bn-globally-by-2031-at-24-2-cagr-allied-market-research-301580103.html)

Related Courses

Related Technology Solution

InTone RA7 A.I™

Fraud Detection & Mitigation Solution

Write your awesome label here.